After RBI's rate cuts several banks have reduced interest rates (on both loans and deposits) in the recent times. Some banks haven't done that yet. In addition to rate cuts there are instances where one lender would be better than another (your current loan vendor). In such cases it makes sense to switch your home loan provider. Now this is not a simple process and involves the following steps as neatly described by SwitchMe.

So switching a home loan is time consuming and cash burning process. However if done right it can help you save cash in long run. SwitchMe is a provider who claims to help home loan consumers switch their vendors with ease.They also claim to have helped people save over ₹170 Cr. with their services!

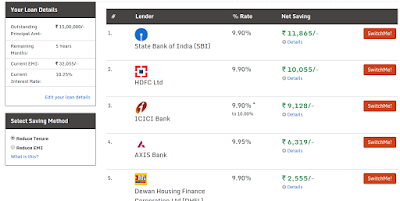

I provided some random inputs to assess the quality of suggestions. When the amount involved was smaller, say ₹3 L and the remaining tenure was just 3 years @ 10.25% interest, I was suggested to stay with current provider as my savings were considered negligible. Additionally it turns out that even banks at times are reluctant to accommodate such small tenure loans. Once I tried providing bigger inputs I got some good suggestions. Sample these -

SwitchMe seems to charge ₹5000 for their services - I got the same quote for both the queries I made. Overall SwitchMe can be a good resource for anyone who is -

- Casually evaluating the benefits of a home loan switch

- Hard pressed for time to complete the paper formalities required to switch a service provider

With the help of services of Viventium Home Loans nz arranging funds for buying a home is not remains anymore as a difficult task. Today this firm is a reputed name in home loans markets of the New Zealand. http://coronetboats.fi/lainasummat/vippi-400/

ReplyDelete